Get funded up to $200K with no time limits and up to 90% profit split

✅ Pros

- Up to 90% profit split

- No time limits on challenges

- $200K max funding

- Flexible trading rules

- Free dashboard analytics

❌ Cons

- Seen to be harder than other prop firms

- Evaluation challenges require consistency

FunderPro Prop Firm Review (2026): A Detailed Look at Funding, Payouts, Rules, and Real Trading Potential

The proprietary trading space has evolved rapidly, moving from niche industry to mainstream opportunity for retail traders who want access to capital without risking their own. Within that landscape, FunderPro has positioned itself as a performance-driven prop firm focused on funding disciplined traders, enabling capital scaling, and prioritising consistent payouts.

For anyone searching whether FunderPro is legitimate, worth the cost, or competitive with other prop firms, the real answer sits in the structure of the firm itself. A prop firm is not judged purely by marketing claims. It is judged by its rules, its funding model, its payout consistency, and how sustainable it is for traders over the long term.

This article takes a full editorial look at FunderPro from a trader’s perspective, breaking down how the firm works, what makes it attractive, where it may present challenges, and who it is actually built for.

Understanding the FunderPro Model

FunderPro operates as a proprietary trading firm offering funded accounts through performance-based models. Traders typically gain access to capital by either passing evaluation phases or entering through instant funding pathways.

The evaluation structure exists to test consistency. Rather than rewarding short bursts of profitability, it focuses on whether a trader can manage risk and execute a repeatable strategy. This approach reflects how institutional trading desks operate. Discipline matters more than aggressive risk-taking.

Once the trader meets the firm’s performance requirements, they move into a funded environment and begin earning from profit splits. From there, the relationship shifts from challenge participation to long-term trading partnership.

Funding Pathways and Entry

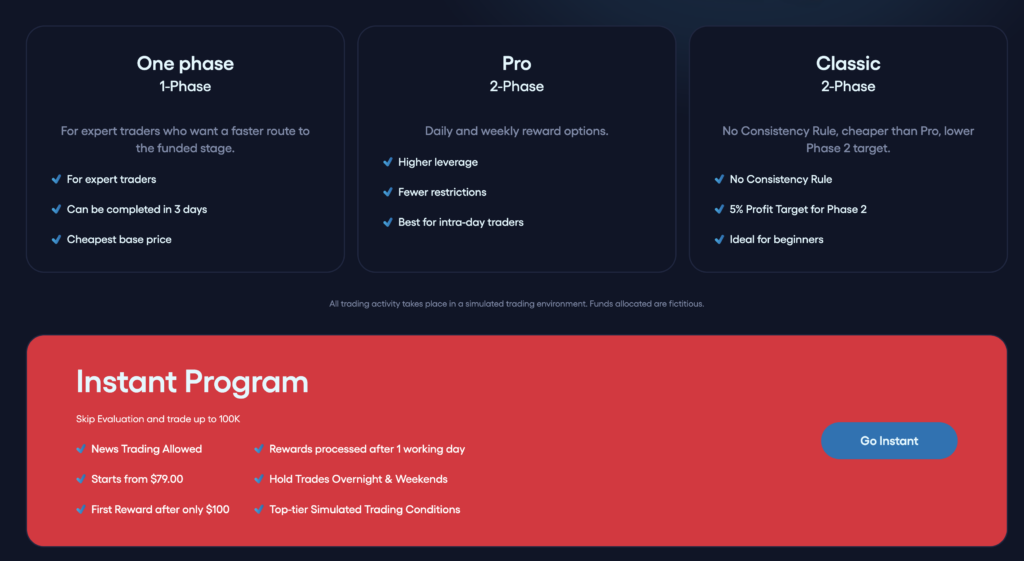

The journey into funded trading is one of the biggest decision points for any trader considering a prop firm. FunderPro offers multiple routes into capital, which changes how traders approach the opportunity.

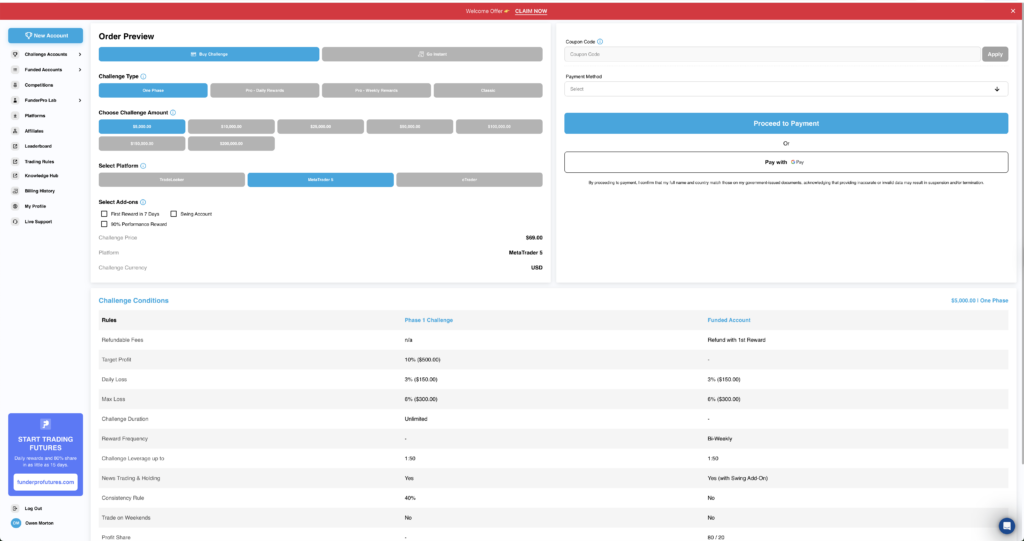

Evaluation accounts require traders to meet profit targets while respecting drawdown limits and operational rules. This path appeals to structured traders who prefer proving performance before accessing capital.

Instant funding options remove the evaluation timeline and allow traders to begin working with funded accounts sooner. These accounts often come with tighter controls but offer speed and accessibility. For experienced traders, this can reduce friction and accelerate earning potential.

The availability of both models signals a firm attempting to serve different trader profiles rather than forcing everyone through the same entry route.

Trading Environment and Strategy Flexibility

The environment in which traders execute is a major factor in whether a prop firm is usable long term. Strategy flexibility can determine success or frustration.

FunderPro supports multiple trading platforms and allows a range of trading approaches, including discretionary trading, automated systems, intraday execution, and swing strategies. This flexibility matters because traders rarely succeed when forced into rigid systems that don’t match their strategy.

Rather than dictating one method, the firm focuses on risk control and consistency. The structure suggests that as long as traders manage drawdown and follow operational rules, they retain autonomy over how they trade.

This type of flexibility is often what separates long-term prop firm participation from short-term challenge attempts.

Risk Framework and Trading Rules

Every prop firm builds its foundation around risk. FunderPro is no exception.

The drawdown model is designed to keep risk defined and predictable. Traders operate within set limits that reinforce discipline rather than encouraging aggressive leverage. Daily limits also help prevent emotional decision-making, which is often the main cause of failure in funded trading environments.

Rules may initially feel restrictive, particularly for traders used to operating without constraints. However, those same rules are what allow prop firms to provide capital at scale. They ensure traders treat trading as a structured activity rather than speculation.

Payout Structure and Trader Incentives

Payout consistency is where trust is built in the prop firm industry. Traders care less about promises and more about the ability to withdraw profits repeatedly.

FunderPro positions itself strongly around recurring payouts, structured withdrawal eligibility, and profit sharing. Rather than focusing only on passing challenges, the firm’s messaging centres around ongoing trading relationships and long-term earnings.

This approach changes the psychology of participation. The opportunity becomes less about a one-time pass and more about building a sustainable performance track record.

Advantages of the FunderPro Approach

The firm’s strengths come from structure rather than hype.

It offers a pathway for traders to access capital without risking personal funds. It supports different trading styles, which helps traders maintain consistency. The scaling model also provides a long-term trajectory, allowing traders to grow allocations over time rather than being capped at a fixed level.

For disciplined traders, these factors combine into a framework where trading becomes performance-driven income rather than isolated wins or losses.

Where Traders May Face Challenges

No prop firm is easy. Success depends more on the trader than the firm.

Evaluation stages require consistency, which can be difficult for those still developing strategies. Risk limits demand discipline, and traders who rely on aggressive leverage may struggle to adapt.

The simulated environment during early stages may also create psychological friction for traders who prefer direct live market exposure.

These challenges are not unique to FunderPro; they are part of the broader prop firm model.

Who the Firm Is Best Suited For

The structure is best aligned with traders who already have a repeatable strategy and understand risk management.

Those who approach trading as a business rather than a gamble tend to perform better in this environment. The model rewards patience, discipline, and consistency rather than speed.

Beginners seeking shortcuts are less likely to succeed, not because of the firm itself, but because trading requires structured decision-making and emotional control.

Long-Term Opportunity and Growth

The real opportunity lies in scaling. Initial funding is only the first step. Traders who demonstrate consistent performance can increase account allocations, grow profit share, and create recurring payout cycles.

Over time, this transforms prop trading from a challenge-based model into a performance partnership. That transition is where the real value sits.

Final Perspective

FunderPro represents a modern prop firm designed around structured trading rather than marketing promises. It provides access to capital, enforces discipline, and offers scalability for traders who can perform consistently.

Its strengths come from flexibility, payout positioning, and a framework that prioritises long-term performance. Its difficulty comes from the reality of trading itself.

For traders who treat trading as a structured activity and are willing to operate within defined risk parameters, it presents a credible path toward funded trading and recurring profit potential.

For those looking for shortcuts, the environment may feel demanding.

Ultimately, success with FunderPro — like any prop firm — depends less on the firm and more on the trader’s ability to execute consistently within a rules-based system.

-***Do your own research; any information on this page or pages can not be seen or taken as financial advice. Details of this page may change since publication. Do your own research.***-

More Reviews

Trade futures with up to $300K funding and industry-low commissions

Multi-asset broker with tight spreads, copy trading, and crypto support

AI-driven trade signals and automated execution with smart risk management