AI-driven trade signals and automated execution with smart risk management

✅ Pros

- AI-driven signal generation

- Automated or manual execution modes

- Multi-market coverage

- Transparent confidence scoring

- Smart risk management

- Pay with Card and Crypto Currencies

❌ Cons

- AI performance varies in volatile markets

- Relatively new platform

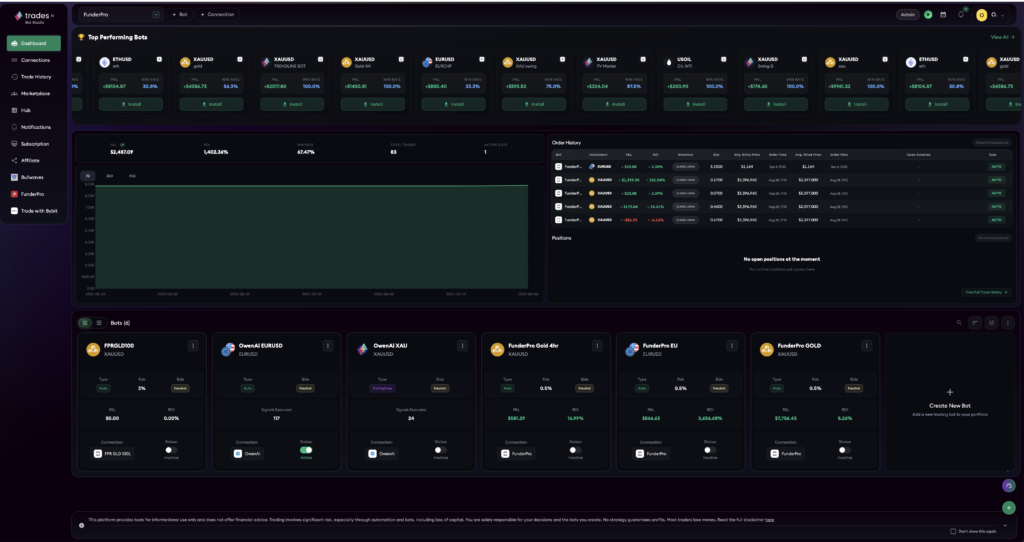

TradesAI Studio Review (2026): Full Breakdown of the AI Trading Platform, Features, Automation and Real-World Use

The rapid rise of AI trading tools has changed how traders approach the markets. Platforms now promise automation, strategy building without coding, and machine-driven insights that operate around the clock. One of the platforms attracting attention in this category is TradesAI Studio — an automation environment designed to help traders build, test, and deploy AI-powered trading systems.

This review delivers a full editorial analysis of the platform as a single article, covering what TradesAI Studio is, how it works, its core features, advantages, risks, and who it is best suited for.

What TradesAI Studio Is

TradesAI Studio is positioned as an AI trading automation platform focused on strategy creation, signal generation, and bot deployment. The platform is designed to help traders automate their strategies using data-driven insights rather than manual decision-making.

Its core proposition centers on enabling traders to build and run trading systems with minimal technical complexity. Some descriptions emphasize no-code functionality, integration with trading platforms and exchanges, and the ability to automate execution workflows.

The product fits into the broader category of AI-driven trading tools — software that analyzes market data and executes strategies based on defined rules or machine-learning signals.

How the Platform Works

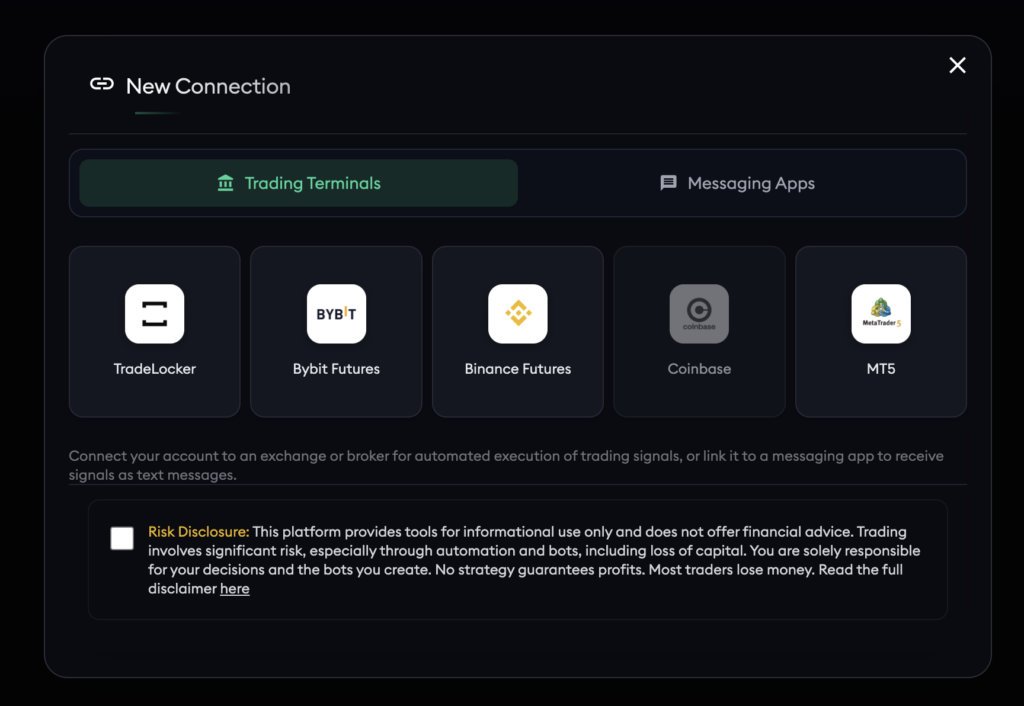

TradesAI Studio operates as a software environment rather than a broker or prop firm. Traders connect the platform to exchanges or trading tools and use it to design automated strategies.

Key workflow stages typically include:

- strategy creation

- automation setup

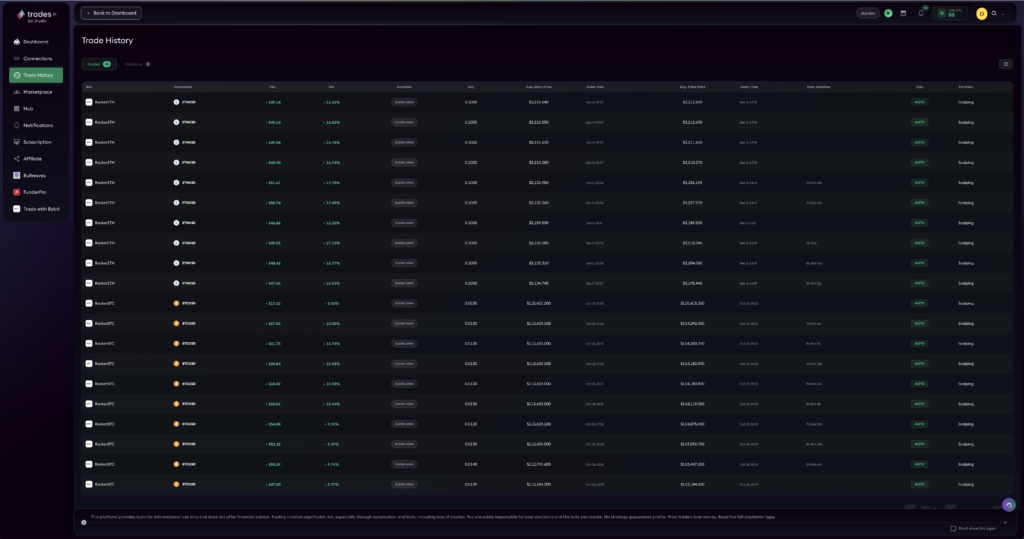

- backtesting

- live deployment

- performance monitoring

The platform connects through API integrations to trading environments while maintaining security controls that limit access to funds.

This structure is common among AI trading tools: automation sits on top of a trader’s own brokerage or exchange accounts.

Core Features and Capabilities

1. No-Code Bot Building

The platform is designed to allow traders to build trading bots without programming, translating strategy logic into automation workflows.

This makes the platform accessible to:

- discretionary traders

- analysts

- signal providers

- algorithmic beginners

2. AI-Driven Insights

TradesAI promotes machine-driven analysis designed to process market data and support trading decisions.

AI trading platforms in general aim to analyze large data sets, identify patterns, and assist traders in making informed decisions.

3. Exchange and Platform Integrations

TradesAI Studio has been described as connecting with multiple trading environments and exchanges so strategies can execute in real markets.

4. Strategy Sharing and Signal Distribution

Some features highlight the ability to broadcast signals and clone strategies, turning successful trading systems into shareable or monetizable tools.

This moves the platform beyond personal automation into a creator-style ecosystem.

Automation and AI Trading Context

AI trading tools aim to automate analysis and execution by processing vast data volumes and identifying patterns faster than humans.

They are not guaranteed profit systems. Instead, they function as decision-support and execution tools.

General AI trading setups involve:

- defining strategy rules

- connecting via API

- backtesting on historical data

- deploying with controlled risk

These steps mirror how most modern automation tools operate.

User Experience and Reputation

Public reviews for TradesAI are mixed, which is common in trading software markets.

Some users describe the tools as accurate, useful, and supportive for learning or automation. Others express concerns or dissatisfaction depending on expectations and performance outcomes.

The platform holds an average rating in the mid-range across review sites, reflecting a combination of positive and negative experiences typical of algorithmic trading tools.

This variability highlights an important reality: outcomes depend heavily on the trader’s strategy rather than the tool alone.

Advantages of TradesAI Studio

The platform’s strengths come from automation and accessibility.

It allows traders to build strategies without coding, integrate with exchanges, and deploy automation workflows. This reduces the technical barrier to algorithmic trading and makes advanced tools accessible to a broader audience.

The ability to test, automate, and iterate strategies creates a structured environment for performance-driven trading rather than emotional decision-making.

It also supports strategy creators who want to share or monetize signals, adding an additional layer of opportunity beyond personal trading.

Risks and Considerations

AI trading platforms carry inherent risks, and TradesAI is no exception.

Automation does not guarantee profitability. Strategies still require testing, monitoring, and risk management.

Many AI trading failures occur because:

- strategies are poorly designed

- risk management is ignored

- markets change faster than models adapt

Automation can amplify both profits and losses.

Additionally, trader expectations play a major role. Viewing automation as a “money button” often leads to disappointment, while treating it as a tool for disciplined execution produces better outcomes.

Who TradesAI Studio Is Best Suited For

TradesAI Studio aligns best with traders who:

- want automation

- operate structured strategies

- understand risk management

- want to test algorithmic trading without coding

It is less suited for:

- beginners expecting guaranteed profits

- traders unwilling to monitor systems

- individuals treating AI as a replacement for strategy

The platform is a tool — not a trading strategy itself.

Long-Term Potential

The real opportunity lies in workflow efficiency and scale.

Traders who refine strategies and deploy automation effectively can:

- execute consistently

- remove emotional bias

- scale across markets

- manage multiple strategies simultaneously

This transforms trading from manual execution into a process-driven system.

Final Verdict

TradesAI Studio sits firmly in the AI trading automation category. It is not a broker and not a prop firm. It is a platform designed to help traders build, test, and deploy automated trading strategies.

Its value depends on how it is used. For disciplined traders, it provides a structured environment to automate execution and refine strategies. For those expecting instant profitability, it may not meet expectations.

As with any AI trading platform, the technology amplifies strategy quality. Strong systems benefit. Weak ones fail faster.

Ultimately, the platform functions best as a trading tool — not a promise.

-***Do your own research; any information on this page or pages can not be seen or taken as financial advice. Details of this page may change since publication. Do your own research.***-

More Reviews

Trade futures with up to $300K funding and industry-low commissions

Multi-asset broker with tight spreads, copy trading, and crypto support