Trade futures with up to $300K funding and industry-low commissions

✅ Pros

- Purpose-built for futures trading

- Up to $300K funding

- Rithmic & Tradovate integration

- Industry-low commissions

- Real CME data feeds

❌ Cons

- Futures only — no forex or stocks

- Newer product (launched recently)

FunderPro Futures Review (2026): Funding Model, Rules, Payouts and Trader Potential

What FunderPro Futures Is

FunderPro Futures operates as a futures proprietary trading environment where traders complete an evaluation process to demonstrate consistency before gaining access to funded accounts. The structure is designed around performance, risk management, and repeatable execution rather than speculative trading. Traders prove their strategy and discipline first, then transition into funded trading where profits are shared.

This approach reflects how institutional trading desks operate. Consistency and risk control matter more than one-time performance, and capital allocation follows proven execution rather than assumptions.

How the Funding Model Works

The platform uses a staged evaluation model. Traders must reach defined profit targets while remaining within daily and overall drawdown limits. This process ensures that traders can manage risk effectively while building consistent returns.

Evaluation structures typically include profit milestones, maximum drawdown limits, and minimum trading activity requirements. Breaching these rules leads to account resets or disqualification, reinforcing the importance of disciplined execution.

The purpose is not to reward a single strong trading day but to identify traders capable of producing repeatable performance over time.

Profit Targets and Drawdown

Profit targets are structured across phases, requiring traders to demonstrate progression rather than immediate results. Drawdown controls limit risk exposure and ensure that traders operate within defined boundaries.

These mechanisms are essential for protecting firm capital and aligning trader behavior with structured performance expectations.

Consistency Requirements

Consistency rules ensure that performance is balanced over time. Traders cannot rely on one large trade to pass an evaluation. Instead, they must show stability across multiple sessions, reinforcing strategy discipline and risk control.

Trading Platforms and Execution Environment

Futures execution infrastructure plays a central role in the FunderPro Futures environment. Rithmic acts as the execution backbone, enforcing risk parameters and order flow discipline. Front-end platforms such as NinjaTrader and Tradovate provide the trading interface and workflow.

This setup is designed for traders already familiar with futures markets. It supports fast execution, structured order management, and automated enforcement of risk limits.

Institutional Infrastructure

The use of professional execution tools positions the platform closer to institutional environments than retail trading setups. This creates a more structured and performance-focused trading experience.

Platform Experience

The platform environment supports discretionary and strategy-driven traders who rely on precision, speed, and consistency rather than emotional decision-making.

Profit Splits and Payout Structure

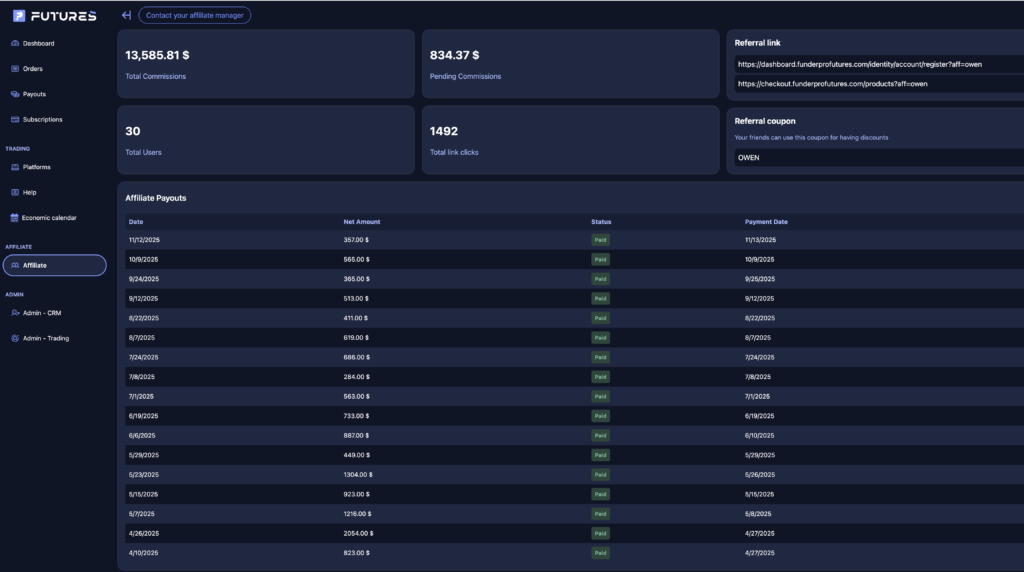

Profit sharing is a key element of the platform. Traders who reach funded status earn a percentage of generated profits, with payouts linked to performance milestones and consistency requirements.

Initial payouts can become available after meeting qualifying conditions, and ongoing withdrawals depend on maintaining disciplined execution.

Withdrawal Cycles

Payout cycles are structured around performance, allowing traders to withdraw profits at defined intervals once requirements are met.

Reward Structure

The reward system encourages sustainable trading rather than one-off success. Traders who maintain consistency benefit from ongoing payout opportunities.

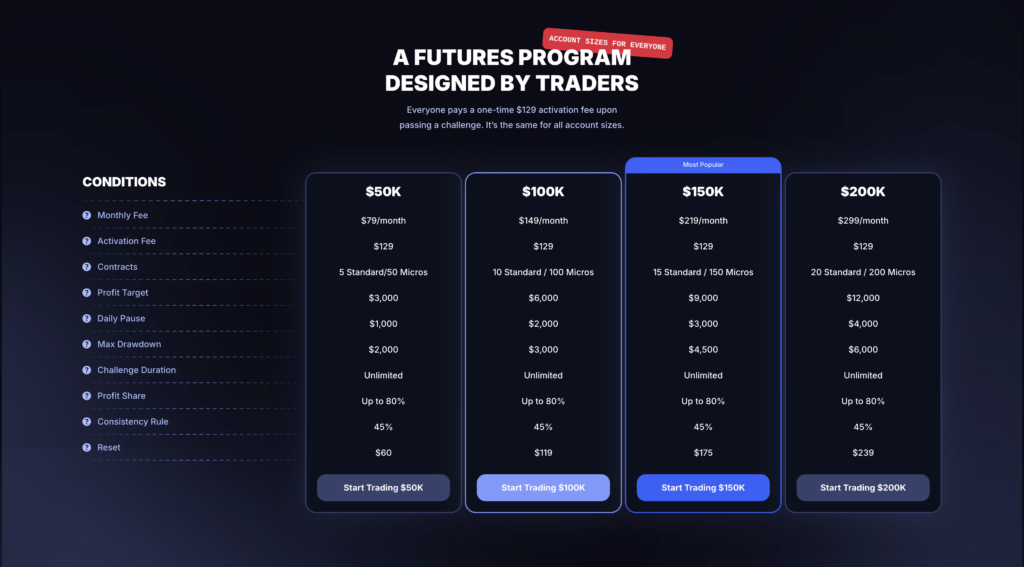

Costs and Account Structure

The pricing model follows common futures prop firm structures. Evaluation participation typically involves recurring subscription fees, while funded accounts may require activation costs. Reset options allow traders to re-enter the process if rules are breached.

This structure balances accessibility with risk management and reflects industry standards.

Advantages of FunderPro Futures

The platform offers a clear path into funded futures trading with institutional execution tools and a structured performance environment. It rewards discipline, supports strategy development, and provides scalability through consistent results.

For experienced futures traders, these elements create a performance-driven opportunity built around structured trading rather than speculation.

Structured Funding Path

Traders have a defined pathway from evaluation to funded accounts, making the progression transparent and performance-based.

Strategy Alignment

The consistency rules and drawdown limits support traders who rely on tested strategies and disciplined execution.

Risks and Considerations

Like all futures trading environments, the platform carries inherent risk. Evaluation requirements demand consistency, drawdown rules require discipline, and leverage can amplify losses quickly.

Traders without structured strategies may struggle, particularly if they approach the environment expecting quick success.

Market Volatility

Futures markets are volatile and require careful risk management. Emotional trading or over-leverage can quickly disrupt progress.

Rule Sensitivity

Strict rule enforcement means traders must operate within defined parameters at all times. Failure to do so leads to resets or account loss.

Who FunderPro Futures Is Best Suited For

The program is best suited for traders who already understand futures markets, operate structured strategies, and are comfortable working within defined risk frameworks.

Those who treat trading as a disciplined activity tend to perform better than those approaching it as speculation.

Ideal Trader Profile

Experienced futures traders, strategy-driven participants, and individuals focused on long-term performance are most aligned with the environment.

Less Suitable Participants

Beginners or traders seeking shortcuts may find the structure demanding due to consistency and discipline requirements.

Long-Term Opportunity and Scaling

The real opportunity lies beyond passing the evaluation. Traders who maintain consistent performance can scale capital access, increase payout frequency, and build recurring income streams over time.

This transforms the relationship from challenge participation into a performance-based partnership.

Capital Growth

Scaling is tied to results. Consistent traders can expand their account allocations and earning potential.

Sustainable Performance

Long-term success depends on maintaining discipline and refining strategies rather than relying on short-term gains.

Final Verdict

FunderPro Futures is structured as a dedicated futures trading environment built around discipline, evaluation, and performance. It offers institutional execution tools, a structured funding pathway, and a payout model designed to reward consistent traders.

Its strengths lie in structure, execution infrastructure, and performance alignment. Its challenges stem from the reality of futures trading itself, where leverage and volatility require strict risk control.

For experienced traders who can operate within defined rules, it provides a viable pathway into funded futures trading and long-term performance-driven income.

For those seeking rapid wins or shortcuts, the environment may feel restrictive. Success ultimately depends on the trader’s ability to execute consistently within a structured framework.

-***Do your own research; any information on this page or pages can not be seen or taken as financial advice. Details of this page may change since publication. Do your own research.***-

More Reviews

Multi-asset broker with tight spreads, copy trading, and crypto support

AI-driven trade signals and automated execution with smart risk management